Understanding Depreciation: Impression On Income Statement And Stabili…

페이지 정보

작성자 Julia 댓글 0건 조회 2회 작성일 24-12-27 22:29본문

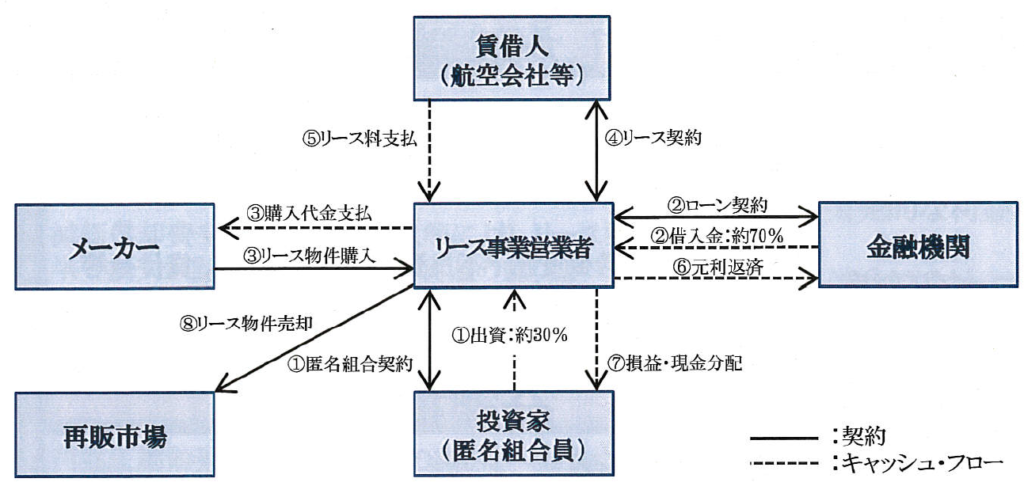

Salvage Value: The estimated value of the asset at the end of its useful life, often known as its residual value. Helpful Life: The estimated number of years or units of manufacturing over which the asset is expected to be used. 2. These strategies contain a extra complicated formula but usually follow the idea of expensing more depreciation within the early years of the asset's life. Direct lending refers to a secured or unsecured mortgage offered for the acquisition of a commercial aircraft. As the price of a business aircraft may be within the tens or a whole lot of million dollars, a single bank will not often have sufficient capital to finance such a purchase. Instead, a syndicate (group) of banks will usually jointly provide the mortgage.

Don’t go up the chance to free up money flow. Make investments with Tap Invest and achieve entry to obligatory property with out paying significant upfront expenses. After learning leasing and its types, let’s move on to Finance Lease. Finance leases offer lengthy-term obligations and duties much like asset ownership. Let’s delve deeper into when and why a finance lease is perhaps the perfect choice for your online business. In a finance lease, the lessee essentially takes on the risks and advantages of owning the asset all through an extended-term lease. Mirroring possession tasks, the lessee bears the accountability for the asset’s upkeep and related bills, despite the fact that the lessor maintains formal possession.

These LCM rules differ from those established for generally accepted accounting (GAAP) rules. You can also probably write down inventory that is deemed to be wholly worthless or utterly obsolete. Evaluating your inventory and considering various inventory strategies could possibly be useful by accelerating the associated value of goods bought tax deduction. Another efficient accounting methodology change that can present profit is the deducting of sure pay as you go bills. What's a Depreciation Expense? Depreciation bills are a fundamental idea in enterprise accounting that reflects the gradual lower in worth of an asset over time. This financial mechanism allows corporations to allocate the cost of tangible belongings throughout their useful life, moderately than expensing all the price at once. Monetary Reporting: オペレーティングリース リスク It provides a more correct representation of a company’s financial place by reflecting the true value of its property over time. Tax Advantages: Depreciation is usually tax-deductible, allowing businesses to scale back their taxable revenue.

Paperback. Situation: new. Paperback. This e-book is written particularly from the airline's perspective, providing explanations for the many complexities of an aircraft operating lease. The creator challenges some established practices that impose big monetary obligations on airways and gives a more equitable alternative method that may save airlines tens of millions of dollars. The e-book dissects clause by clause a sample aircraft operating lease agreement to elucidate the legal rules underlining certain terms and the practical, business and authorized reasons for their inclusion.

- 이전글스페니쉬플라이캡슐, 비아그라 판매처 24.12.27

- 다음글5 How To Treat ADHD Lessons From The Professionals 24.12.27

댓글목록

등록된 댓글이 없습니다.