Tax Benefits: Leveraging Tax Advantages In An Working Lease

페이지 정보

작성자 Bette 댓글 0건 조회 44회 작성일 24-12-27 22:32본문

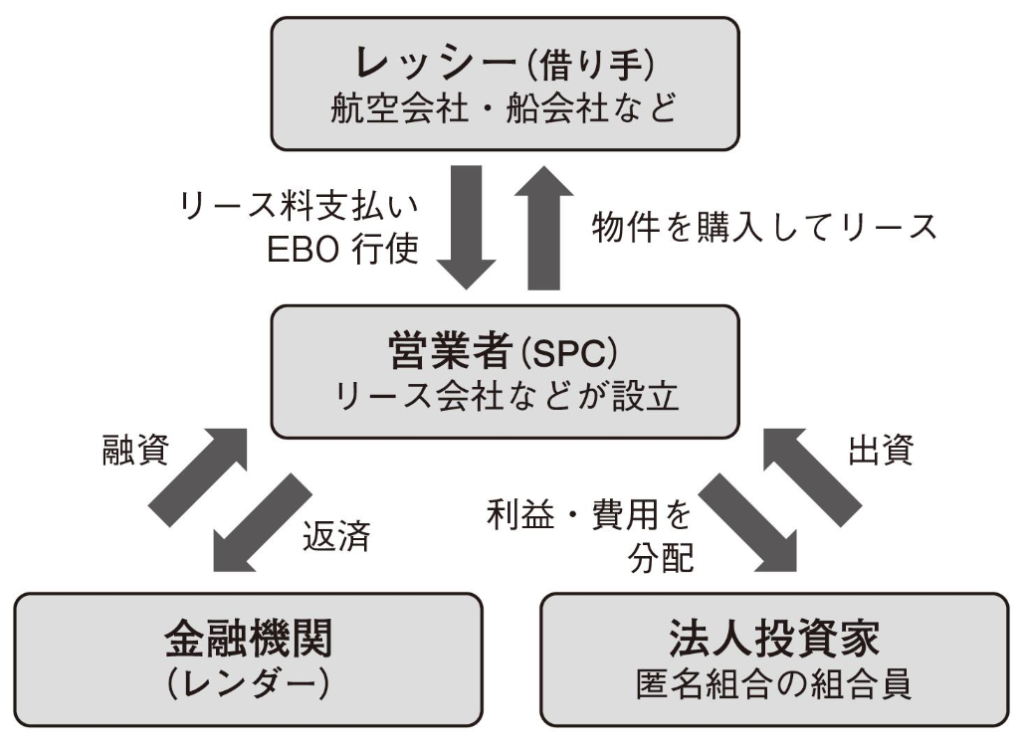

General, it can be crucial for businesses to rigorously consider their choices earlier than selecting between an Operating lease and a Finance lease. Whereas an Working Lease could present more flexibility and tax advantages, a Finance Lease could also be extra suitable for businesses that require ownership of the asset and want to claim capital allowances. Attain out to your tax advisers, ideally in 2024, to determine if you would profit from further planning before the property limits sunset. Contact Matthew Divis at mdivis@cohenco.com, Kayla Lieb at klieb@cohenco.com or a member of your service group to debate this matter additional. Cohen & Co is just not rendering legal, accounting or other skilled recommendation. Data contained on this publish is considered correct as of the date of publishing. Any action taken based mostly on info on this weblog needs to be taken only after an in depth assessment of the precise info, circumstances and current regulation. Through the working lease time period, the lessee makes regular rental funds to the lessor. These payments are typically made on a monthly or quarterly basis and canopy the price of using the property. The lease funds are recorded as expenses on the lessee’s income assertion. From an accounting standpoint, working leases have undergone changes lately. Following the implementation of ASC Matter 842, working leases should now be recognized as both property and liabilities on the lessee’s steadiness sheet. This accounting requirement provides a extra comprehensive and clear view of a business’s financial obligations.

Holding Period: オペレーティングリース 節税スキーム The 529 plan will need to have been open for not less than 15 years earlier than the rollover can occur. Contribution Limits: The quantity rolled over is topic to annual Roth IRA contribution limits, so normal restrictions nonetheless apply. Beneficiary: The rollover must be made to the Roth IRA of the 529 plan’s beneficiary. A 529-to-Roth IRA Rollover can alleviate issues about overfunding a 529 plan, and affords another avenue for tax-advantaged financial savings. The lessee is responsible for the maintenance and depreciation of the asset, and has the choice to buy the asset at a residual value at the top of the lease time period. A monetary lease is often used for assets that have a long useful life, reminiscent of buildings, land, or equipment. For instance, a manufacturing firm may lease a factory constructing from a bank using a financial lease, and purchase the possession of the constructing after paying off the lease.

This allows for more flexibility than longer time period leases. Debt Consideration: Are Operating Leases Thought of Debt? No, operating leases have traditionally been treated as off-stability sheet financing. However new accounting requirements require capitalization of proper-of-use property and lease liabilities on the stability sheet for a lot of leases. Whereas working leases don't present up as debt on the balance sheet, the lease payments are nonetheless a fixed expense that reduces cash circulate obtainable for other purposes over the term of the lease. For Lessors, working leases are good lengthy-time period investments with probably profitable income streams. There is also a sizeable secondary marketplace for lessors to trade aircraft amongst themselves, nearly at all times with the lease "transferred" through a novation or project and assumption relying on jurisdiction. A finance lease in the end confers the economic benefit of the asset on the lessee and is a standard financing software.

댓글목록

등록된 댓글이 없습니다.