Essential Corporate Tax Planning Strategies For UAE Businesses

페이지 정보

작성자 Hassie 댓글 0건 조회 10회 작성일 24-12-27 23:22본문

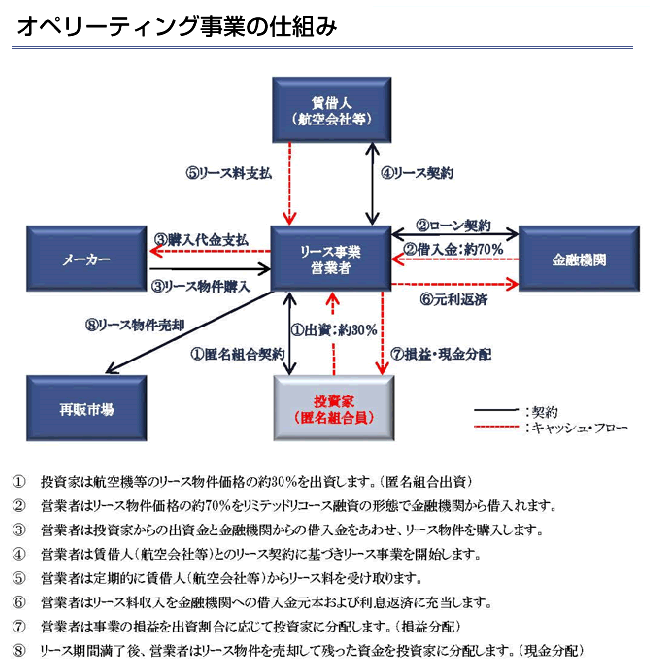

You may need heard about the new company tax modifications in the UAE, and if you’re a business proprietor, you’re probably questioning how this might affect you. Don’t worry, オペレーティングリース 節税スキーム we’re here to break it down for you in straightforward phrases. In this article, we’ll go through the basics of corporate tax planning in Dubai, from understanding the new tax system to sensible methods that will help your corporation save money and run extra smoothly. These added costs can significantly inflate the overall expenditure related to the operating lease, making it vital for organizations to perform cost-benefit analyses. Furthermore, businesses might face the implications of leasing terms which will not always be favorable. If an organization incessantly needs to renew or lengthen leases, the repeating cycle of funds can result in an unanticipated financial burden, which impacts the overall cost efficiency of using operating leases.

Nonetheless, whereas FSA funds are sometimes "use it or lose it," you'll be able to carry over HSA contributions indefinitely. Another glorious tax planning technique is to contribute the utmost quantity towards your retirement plans. 695,000 per 12 months, you’re married filing jointly, and you pay 37% in federal revenue tax. Exterior of your major job, it's also possible to use self-employment to help save on your tax return. Whether you have got a facet hustle doing freelance work or selling art, you possibly can doubtlessly declare a business deduction on all manners of bills. Including your partner to the payroll might enable for doubling your retirement plan contributions talked about above. Likewise, it can also assist improve their future Social Security benefits. The disadvantage is that you will owe payroll taxes on their earnings. Eleven. Are You Utilizing the appropriate Business Entity? Utilizing the correct business entity (for your particular enterprise) could considerably enhance the tax efficiency of what you are promoting.

The SYD methodology derives its name from the calculation course of, which includes summing up the digits of the asset’s useful life. This sum becomes the denominator in a fraction used to determine the depreciation rate for annually. Balanced method: It offers a middle ground between straight-line and declining balance strategies. In most cases, this won't be permitted by the native aviation authority and will have to be structured as a full Charter. For more data on Wet Leasing, please consult with this link: What is ACMI Leasing? The operating lease, often known as a dry lease, is a contract between an aircraft proprietor (or manager) and an operator. An working lease is where the operator rents the aircraft from the proprietor for a defined lease time period, sometimes between 6-12 years, and returns the aircraft to the owner at the top of a lease term.

- 이전글사랑과 관계: 희망과 결실의 이야기 24.12.27

- 다음글A Simple Trick For Explore Daycares Locations Revealed 24.12.27

댓글목록

등록된 댓글이 없습니다.